Introduction

Over the past ten years, gold has experienced significant price fluctuations, influenced by various economic, geopolitical, and market factors. Understanding these trends is crucial for investors, financial analysts, and enthusiasts seeking to navigate the complexities of the gold market.

Historical Price Overview

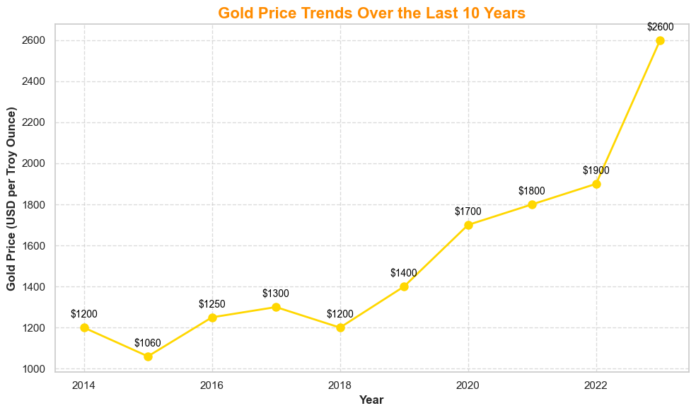

In 2014, gold prices were approximately $1,200 per troy ounce. By 2015, they had declined to around $1,060, reaching a low of $1,049.41 in December 2015. The market then began to recover, with prices rising to about $1,250 by the end of 2016. This upward trajectory continued, peaking at $2,783.95 in October 2024.

Key Factors Influencing Gold Prices

Several factors have contributed to the volatility of gold prices over the past decade:

- Economic Events: The 2008 financial crisis and subsequent economic uncertainties led investors to seek safe-haven assets like gold. Similarly, the COVID-19 pandemic in 2020 prompted a surge in gold prices as markets reacted to global economic disruptions.

- Inflation and Interest Rates: Gold is often viewed as a hedge against inflation. Periods of rising inflation or expectations of future inflation can drive investors toward gold. Conversely, higher interest rates can make non-interest-bearing assets like gold less attractive.

- Geopolitical Tensions: Conflicts and political instability, such as tensions in the Middle East and trade disputes, have historically led to increased demand for gold as a safe-haven investment.

- Central Bank Policies: Actions by central banks, including changes in monetary policy and gold reserve holdings, can significantly impact gold prices. For instance, central banks increasing their gold reserves can drive up demand and, consequently, prices.

Recent Developments

In 2024, gold prices surged, achieving a 27% increase to $2,617.20 per troy ounce, marking the best performance since 2010. Analysts from major financial institutions predict that gold prices could reach $3,000 in 2025, driven by factors such as lower interest rates, geopolitical uncertainties, and increased central bank purchases.

Conclusion

The past decade has seen gold prices fluctuate significantly, influenced by a complex interplay of economic, geopolitical, and market factors. As of January 3, 2025, the price of gold stands at $2,660.82 per troy ounce.

While past performance is not indicative of future results, understanding these trends provides valuable insights for making informed investment decisions in the gold market.